On behalf of the Ohio Public Employees Retirement System (OPERS or System) Board of Trustees, management and staff, it is our pleasure to present this 2015 Popular Annual Financial Report for the fiscal year ended December 31, 2015.

OPERS continues to be a strong system as we report our 80th year of business. Our strength, balance and longevity are the result of our ability to anticipate and adapt to change while remaining steadfast in our mission and principles. OPERS delivers on our promise to provide retirement security to generations of members. We appreciate the work and achievements of those who came before us during our first 80 years and we look forward to the next 80 years.

Karen E. Carraher, CPA

Karen E. Carraher, CPA Blake W. Sherry

Blake W. Sherry Jennifer H. Starr, CPA

Jennifer H. Starr, CPA

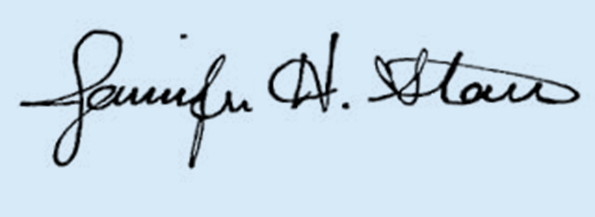

Funded status measures the progress of accumulating the funds necessary to meet future obligations. Historically, periods of diminished funded status were made up as market conditions improved.

Similarly, years of enhanced funded status are eroded when market conditions are poor. OPERS continues to maintain this necessary balance by constantly monitoring and adapting to market conditions.

The December 31, 2015 valuation shows a funded status of 85.0%, with the unfunded liability expected to be funded within 19 years.

“I appreciate OPERS because I knew I had a solid retirement waiting for me when I left my position at OSU after 38 years. It’s comforting to know my daughter Rhonda, an OPERS benefits supervisor, will have the same waiting for her. After my husband passed away in March, I was totally lost. Rhonda guided me through the process. I couldn’t have figured it all out without her. She not only did that for me, but she helps OPERS members and retirees to understand their benefits every single day.”

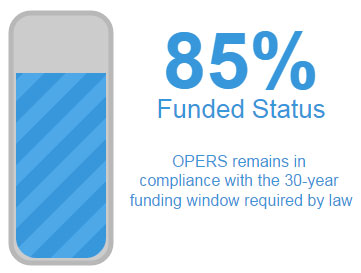

The mission of the System is to provide financial security for our members in retirement. We do that by accepting contributions throughout an individual’s working career. With careful, systematic investing to maximize earnings and the compounding effect of long-term contributions, OPERS has maintained an 80-year tradition of providing financial security to our members. OPERS provides retirement benefits that include pension payments, disability benefits and survivor benefits. This chart represents pension annuities and installment payments for the years presented.

In 2015 Joan Stack was nominated by her peers and won the highest OPERS associate honor, the Neil V. Toth Leadership Award. As Head Trader for OPERS Internal Equities Trading, Joan is responsible for the outcome of portfolio management decisions on a daily basis that impact billions of dollars in funds OPERS invests to provide secure retirements for our members. Joan was named one of the Wall Street Women 2014 Mentors of the Year by Traders magazine.

The 2015 investment market was frustrating and yielded low returns for all the OPERS pension and health care portfolios. The OPERS total return was a loss of 0.03% or (0.03%), substantially less than the expected rate of return of 8% but better than the benchmark return of (0.06%).

While these results are disappointing, OPERS is a long-term investor. We have managed to maintain a strong funding status throughout the market turmoil. While the actuarially established benchmark return for each portfolio was not attained, the Defined Benefit portfolio did provide a positive return and, most importantly, remained positioned for better results.

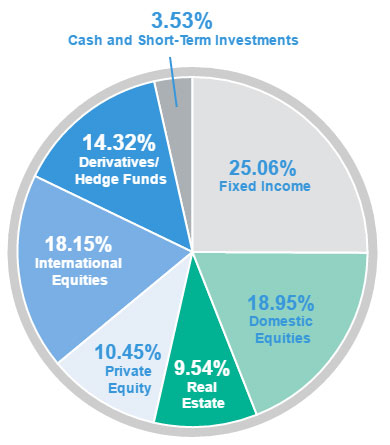

OPERS invests in a diverse set of asset classes to minimize risk. We periodically review the asset allocation to balance the appropriate level of expected risk and return, relative to the characteristics of the liabilities we ultimately expect to fund. The most common message from experts for investing in any economy is to keep asset allocation plans intact in both strong and weak markets. Adhering to Board policies, OPERS did just that in 2015.

A complete discussion of OPERS’ investment returns, activities, asset allocation strategy, and policies governing those activities can be found in the Investment Section of the 2015 Comprehensive Annual Financial Report.

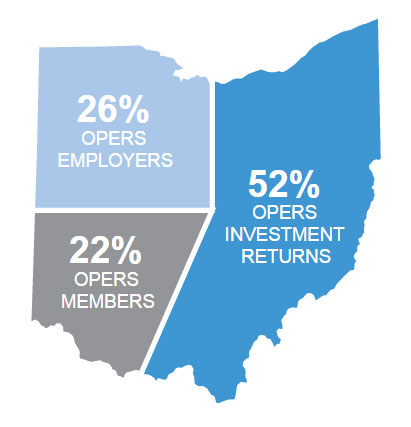

For those retiring in 2015, 74% of the lifetime pension is funded by employee payroll deductions and investment income. The remaining 26% is funded by employer contributions. For every dollar paid by employers, the economy realized a direct return of $3.87.

Pension benefit payments approaching $4.9 billion this year were distributed throughout Ohio to retirees and their beneficiaries, representing OPERS' impact on the state’s economy.

“The word that comes to mind when I think of OPERS is ‘security.’ Security for me, my wife and my entire family. I will be a third generation OPERS benefit recipient - following in the footsteps of both my parents and my grandmother. I have firsthand knowledge of the significance and value of receiving an OPERS pension and I am extremely proud to be a member.”

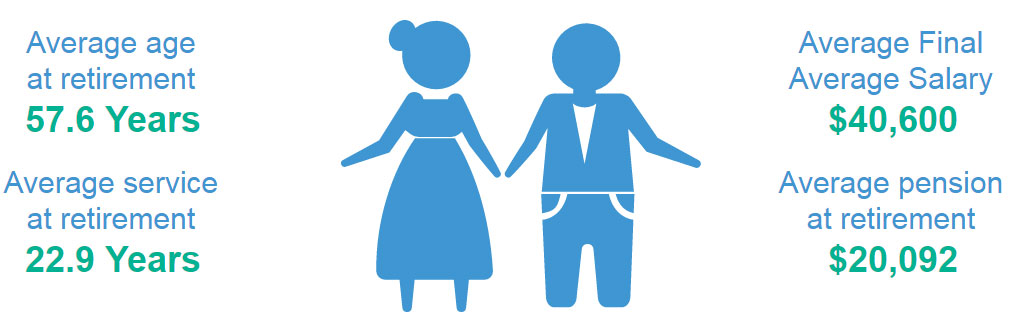

The graphic below shows the average benefits paid to retirees receiving an age-and-service benefit under the Traditional Pension Plan. The cost of retirements will continue to increase as new retirees with higher final average salaries replace long-time retirees with lower final average salaries.