Defined benefit plans are good for Ohio

As one of several non-covered states, most of Ohio's public employees do not pay into Social Security; instead, they rely on the pension benefits they receive from Ohio's public retirement systems for their retirement security.

These benefits are funded largely through the investment returns made by Ohio's five statewide retirement systems. The balance of the funding is provided by contributions from both members and their employers. New OPERS employees contribute 10 percent of their salary into the plan and employers contribute an amount equal to 14 percent of the employee's salary.

OPERS members have received dependable retirement income year in and year out, through economic booms and busts, for more than 80 years. More than that, OPERS members who participate in our Traditional Pension Plan cannot outlive their retirement benefits, eliminating a major source of post-retirement stress and anxiety.

At the same time, contributions to Ohio's public retirement systems are multiplied and redistributed into local economies, supporting jobs and economic activity. Consider that, last year, OPERS paid out more than $6 billion in pension benefits and health care coverage. Many are not aware that as much as 90 percent of OPERS' retirees remain in Ohio following retirement, and the benefits they receive are used to purchase goods and services throughout the state. Additionally, the retirement security provided through Ohio's public retirement systems makes it less likely that our members will deplete their savings, slip into poverty, and be forced to rely on taxpayer-funded public assistance programs like Medicaid or food stamps.

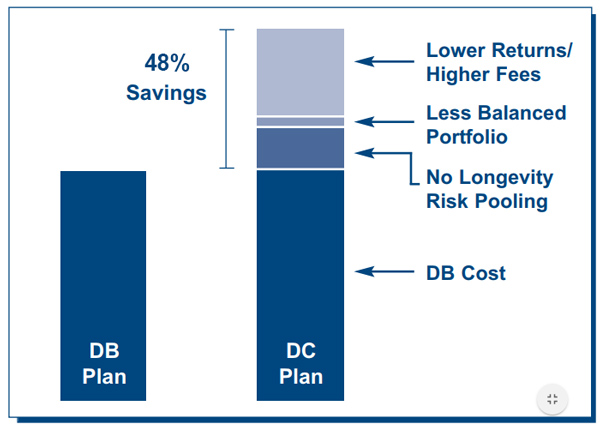

Multiple studies show that defined benefit plans – like those offered by the Ohio retirement systems – are more efficient to run than their defined contribution counterparts. Specifically, defined benefit plans pool longevity risk (the risk of a person outliving his or her accumulated retirement savings and/or contributions), and achieve higher investment returns through professional management with lower fees.

The National Institute on Retirement Security found that the cost to fund a target retirement benefit under a defined benefit plan is over 10 percent of payroll less each year than the cost to provide the same target retirement benefit under a defined contribution plan. In other words, the defined benefit plan can provide the same benefit at a cost that is 48 percent lower than the defined contribution plan1, as shown in figure 1.

In short, OPERS' Traditional Pension Plan – and defined benefit plans in general – cost less in the long run, lessen dependence on public assistance, and are designed to withstand market volatility with a long-term time horizon and diversified investment strategy.

With that said, OPERS offers members three choices in their plan selection: the Traditional Pension Plan (a defined benefit plan), the Combined Plan (a hybrid defined benefit and defined contribution plan) and the Member-Directed Plan (a defined contribution plan). And yet, the vast majority of members select the Traditional Pension Plan.