How and when can I enroll in the HRA?

Active members applying for an OPERS benefit:

Once OPERS receives your retirement benefit application and confirms your health care eligibility, whether you are Pre-Medicare or Medicare-eligible, you will receive information from both OPERS and Via Benefits regarding the HRA, medical plan enrollment and the OPERS vision and dental plans. Via Benefits will reach out to you regarding making an enrollment appointment and provide you with an Enrollment Guide. This Guide offers step-by-step instructions for establishing the HRA and receiving reimbursements. Please read these materials carefully.

I am:

Enrollment requirements – Pre-Medicare

If you are retiring with an OPERS benefit under the age of 65 and are not yet Medicare-eligible, you must opt in to the HRA and you can enroll in any medical plan you choose. Although it's not required, if you are looking for a medical plan, we highly recommend exploring coverage options with the OPERS Connector.

Via Benefits is a resource that helps benefit recipients understand and navigate individual and family health plan options.

Pre-Medicare Funding Options

In addition to the HRA funded by OPERS, depending on income level, some Pre-Medicare benefit recipients (under the age of 65 and not Medicare-eligible) may also be eligible for subsidies from the federal government in the form of a Premium Tax Credit (PTC) and/or a Cost Sharing Reduction (CSR). By law, you can't accept the OPERS HRA and get a federal subsidy at the same time. If you're eligible for both, you'll need to decide which type of funding support works best for you. Via Benefits can help you evaluate your options.

As a Pre-Medicare benefit recipient, you are not required to enroll in a medical plan through Via Benefits to receive monthly HRA deposits or receive reimbursements. However, you will be required to do so once you become Medicare-eligible. This is a good reason to begin your relationship with Via Benefits now.

Attaining eligibility for the HRA at age 60

If you are retiring prior to age 60 and are not eligible for the HRA until you reach age 60, you will need to take action to begin receiving HRA deposits from OPERS as you approach your 60th birthday. This information also applies if you are receiving an OPERS benefit and will attain eligibility for the HRA at age 60. To begin receiving HRA deposits from OPERS, you will need to opt in to the HRA through the OPERS Connector. Approximately four months prior to your 60th birthday, OPERS will send you a letter containing the monthly HRA deposit amount you are eligible to receive, the deadline by which you must opt in to the HRA and detailed instructions. If you do not opt in to the HRA by contacting Via Benefits by this deadline, your next opportunity to opt in will be during open enrollment with an effective date of January 1 the following year.

If you decide to opt out of the HRA on or before your deadline to opt in, your election to opt out is effective the first of the month you became eligible for the HRA.

If you change your election, the last election made as of your deadline to opt in is final and will be effective the first of the month you became eligible for the HRA.

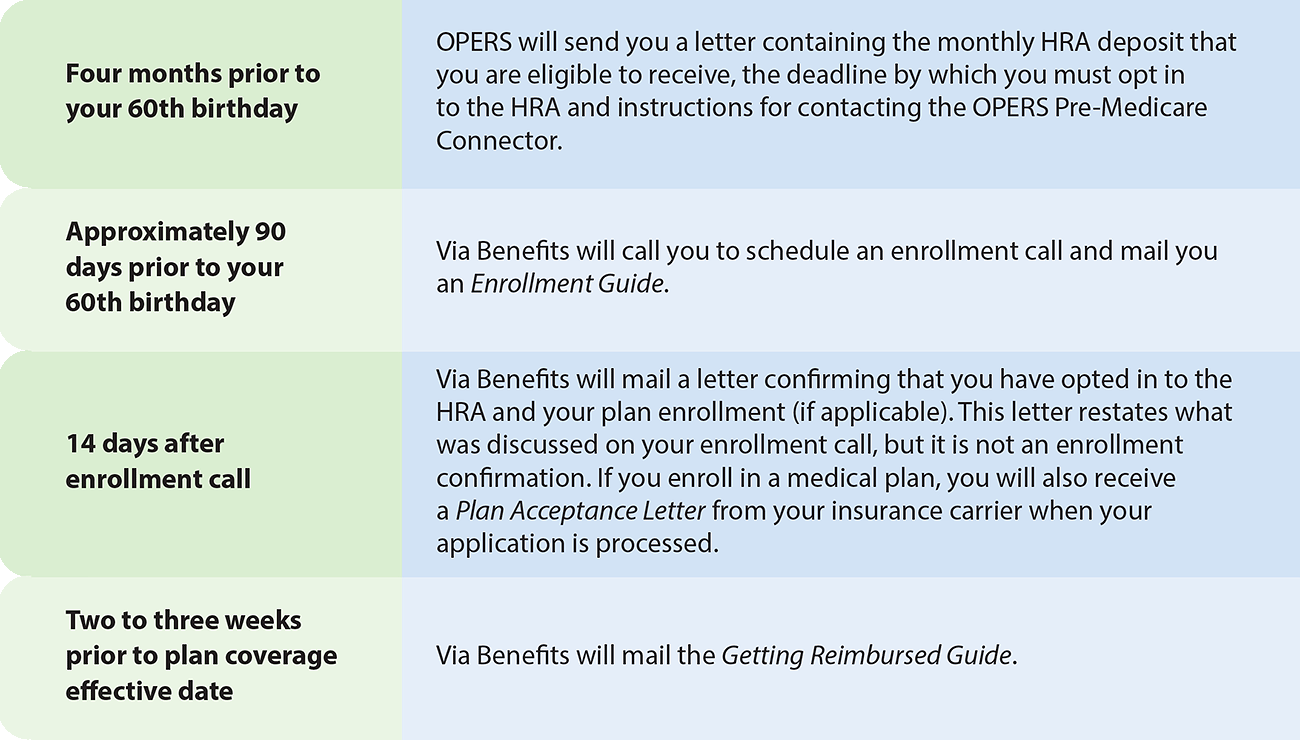

Communications to expect when attaining eligibility at age 60

Enrollment requirements – Medicare-eligible

OPERS members and benefit recipients who have attained Medicare-eligibility must be enrolled in Medicare Parts A and B and in an individual Medicare plan through Via Benefits to receive a monthly HRA deposit from OPERS. If you decide not to enroll in Medicare coverage because of active employment or any other reason or if you fail to enroll in a Medicare medical plan through Via Benefits, you will not be eligible to receive HRA deposits.

If you are receiving HRA deposits as a Pre-Medicare benefit recipient, you will receive information from OPERS regarding the steps you need to take to continue receiving a monthly HRA deposit as a Medicare-eligible benefit recipient.

Medicare Enrollment at age 65

Whether you are a Medicare-eligible OPERS benefit recipient or a Medicare-eligible OPERS member applying for a retirement benefit, you must enroll in Medicare Parts A and B. Medicare provides about 80 percent coverage and will be considered your primary insurance. Once enrolled in Medicare, you will then choose an individual Medicare plan (Medigap or Medicare Advantage) using the OPERS Connector administered by Via Benefits. A Medigap plan will pay after Original Medicare; a Medicare Advantage plan replaces Original Medicare. As an enrollee in either a Medigap or Medicare Advantage plan, you are responsible for paying your Medicare Part B premium. Your Medicare Part B premium is eligible for reimbursement from the HRA if you choose.

Medicare Enrollment

The Social Security Administration permits enrollment in Medicare Parts A and B during certain times depending on your circumstances. While most have access to premium-free Medicare Part A coverage, there is a monthly premium for Medicare Part B coverage. For more information about enrolling in Medicare Parts A and B, visit ssa.gov or call 1-800-772-1213.

Medicare Enrollment Periods

- Initial enrollment period: Three months before and three months after the month in which you turn 65

- General enrollment period: Jan. 1 through March 31 with an effective date of July 1

- Annual Medicare enrollment period: Oct. 15 through Dec. 7

- Special enrollment period: Occurs when you are 65 or older and your coverage, or your spouse's coverage ends through an employer

Medicare Eligible prior to age 65

If you are or become eligible for Medicare due to a qualifying Social Security disability or End Stage Renal Disease*, you must complete the following steps:

- Enroll in Medicare Parts A and B upon being notified of your eligibility

- Provide OPERS with a copy of your Notice of Award or documentation issued by the Social Security Administration (SSA) that includes all the information listed here. You may find this information by logging into your "my Social Security" account by going to www.ssa.gov/myaccount (link opens in new tab) or calling 1-800-772-1213.

- The date that you were first notified that you were eligible for Medicare

- Your Medicare effective date(s) of coverage

- Your Medicare claim number

- Enroll in a medical plan through the OPERS Medicare Connector to receive a monthly HRA deposit.

* If you have ESRD and are within your first 30 months of dialysis you are not required to apply for Medicare. However, if you become entitled to Medicare, you will need to enroll in both Medicare Parts A and B and enroll in a medical plan through the OPERS Medicare Connector to continue to receive an HRA.

Selecting a Medicare plan through the OPERS Connector (Via Benefits)

The OPERS Connector will provide access to a wide assortment of Medicare plans from over 90 of the largest and most popular national and regional health insurance companies. They will help Medicare-eligible benefit recipients find and enroll in an individual Medicare plan.

It is important to understand what to expect and how to prepare in the months leading up to selecting a plan.

Selecting an individual Medicare plan

- Enroll in Medicare Parts A and B with Social Security.

- Call Via Benefits or go online to schedule your enrollment call.

- Enroll in your plan(s) either online or during your scheduled enrollment call

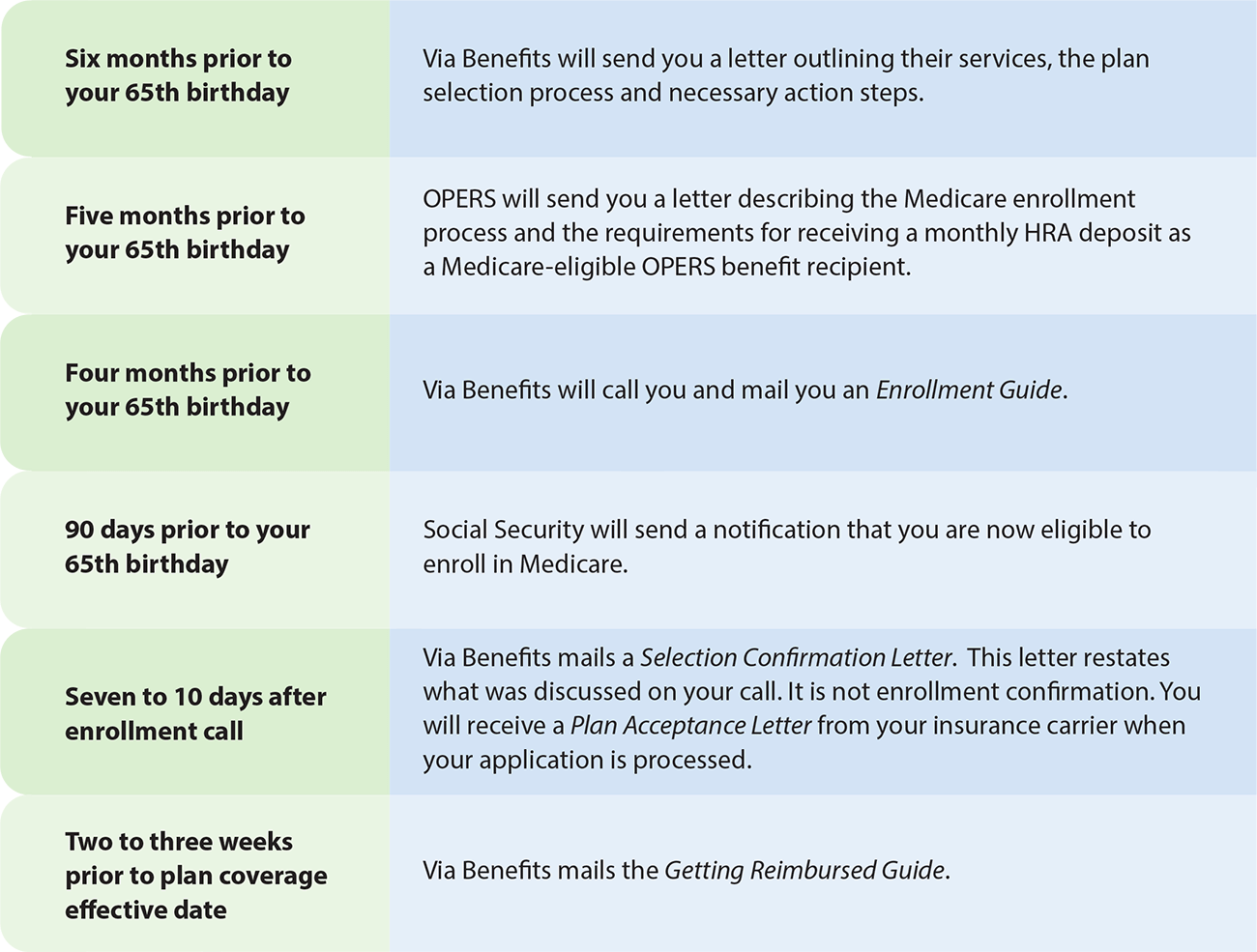

Communications to Expect

As you approach Medicare-eligibility, keep an eye out for important communications from Social Security, Via Benefits and your insurance carrier.