Member Library Read OPERS documents, handbooks, newsletters and more

OPERS Basics

Leaving OPERS/Retirement

Member Newsletters

- Active Members Newsletter

– Winter, 2025/2026 (PDF opens in new tab) - Active Members Newsletter

– Summer, 2025 (PDF opens in new tab)

Retiree Newsletters

- Retiree Newsletter

– Winter, 2025 (PDF opens in new tab) - Retiree Newsletter

– Summer, 2025 (PDF opens in new tab)

Member Handbook

The Member Handbook is a comprehensive overview of the benefits of membership with OPERS.

Read the Member Handbook (PDF opens in new tab)Benefit Recipient Handbook

The Benefit Recipient Handbook is an excellent source of information for OPERS benefit recipients. It details the benefit process and provides information on health care, taxes and re-employment. Please take some time to read through this handbook and keep it for future reference.

Read the Benefit Recipient Handbook (PDF opens in new tab)Saving For Retirement

While you are required to contribute to the OPERS, there are other ways to create additional retirement income.

You can supplement your mandatory OPERS contributions by making voluntary contributions to your plan or by participating in the Ohio Public Employees Deferred Compensation Program, a 457(b) plan. These additional contributions provide an opportunity to save money and supplement your retirement income.

Read: Saving For Retirement (PDF opens in new tab)Additional Annuity Program

The Additional Annuity Program is an account, independent of your OPERS contributions, that allows you to deposit funds or roll over other retirement accounts and annuitize them at the time of your retirement.

The Additional Annuity Program is available to Traditional Pension Plan contributors and re-employed retirees contributing to a Money Purchase Annuity.

Read: Additional Annuity Program (PDF opens in new tab)Service Credit & Contributing Months

Service credit in the Traditional Pension Plan and Combined Plan or contributing months for Member-Directed Plan participants represents the period of time you are employed by a public employer and making contributions to OPERS. You may also be eligible to purchase service credit and, in some instances, free credit may be available.

Depending on your plan, service credit and contributing months can be important factors in determining both eligibility for and calculation of your retirement benefit.

Read: Service Credit & Contributing MonthsChanging Your Retirement Plan

If you are actively contributing to an OPERS Retirement Plan, you may be able to change your retirement plan to one of the other two plans.

A plan change can only be made once during your career and only while you are actively contributing to OPERS.

Read: Changing Your Retirement Plan from the Traditional Pension Plan (PDF opens in new tab) Read: Changing Your Retirement Plan from the Member-Directed Plan (PDF opens in new tab) Read: Changing Your Retirement Plan from the Combined Plan (PDF opens in new tab)

Impact of Part-Time, Seasonal, and Intermittent Employment on Your OPERS Retirement Account

When you work part-time, intermittently, or seasonally for an OPERS-covered employer, your OPERS retirement plan may be impacted. This fact sheet outlines how your work status may affect your retirement planning.

Read: Impact of Part-Time, Seasonal, and Intermittent Employment (PDF opens in new tab)

Retiring From Public Employment

As you begin to consider retirement and make the transition from active member to retiree, you need to have a full understating of the retirement application process under your chosen retirement plan. This includes documents required to process your application and important dates and deadlines.

Read: Retiring From Public Employment - The Traditional Pension Plan (PDF opens in new tab) Read: Retiring From Public Employment - Member-Directed Plan (PDF opens in new tab) Read: Retiring From Public Employment - Combined Plan (PDF opens in new tab)

Terminating Public Employment

As a member of OPERS you have options when it comes to leaving public employment.

Regardless of the OPERS retirement plan in which you participate, you may leave your account on deposit with OPERS or take a lump-sum refund upon leaving an OPERS-covered position. Each option will have an impact on your status with OPERS.

Read: Terminating Public Employment (PDF opens in new tab)Returning to Work After Retirement

Once you retire under any of the OPERS retirement plans, re-employment in a job that is covered by OPERS, including service in an elected position, may affect continuing receipt of benefits. Retirees who become re-employed must notify the employer that they are receiving an OPERS retirement benefit.

Read: Returning to Work After Retirement (PDF opens in new tab)Survivor Benefits

Under the Traditional Pension and Combined plan, your loved ones may qualify to receive survivor benefits should you pass away before you retire or while you're receiving a disability benefit.

Depending on who you designate as your beneficiary, your survivors will receive either a lump sum refund or monthly benefits.

Read: Survivor Benefits (PDF opens in new tab)Income Tax Guide for OPERS Benefit Recipients

As a retired OPERS member, the beneficiary of a deceased OPERS retired member or a member receiving a disability benefit, your retirement benefit must be reported on your federal income tax return.

Read: Tax Guide for OPERS Benefit Recipients (PDF opens in new tab)Partial Lump Sum Option Payment (PLOP)

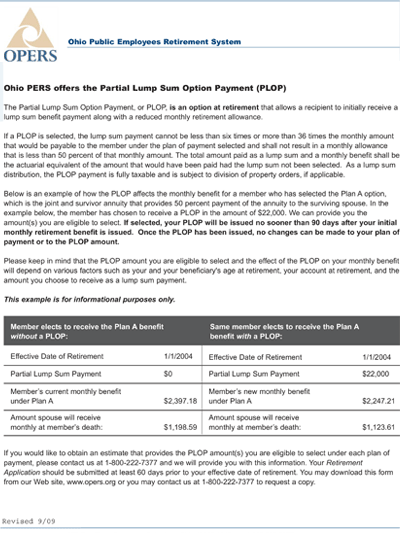

This summarizes the Partial Lump Sum Option Payment (PLOP) — an option at retirement that allows a recipient to initially receive a lump sum benefit payment along with a reduced monthly retirement allowance — and shows an example of how it would affect a recipient's monthly benefit.

2026 OPERS Health Care Program Guide

If you're in the Traditional Pension and Combined plans and qualify for health care coverage at retirement, this guide will help you understand your plan options.

Read: OPERS Health Care Program Guide(2025 Health Care Program Guide) (PDF opens in new tab)

2026 Vision and Dental Plan Guide

If you're in the Traditional Pension and Combined plans and qualify for health care coverage at retirement, this guide will help you understand your vision and dental options.

Read: Vision and Dental Plan Guide(2025 Vision and Dental Plan Guide) (PDF opens in new tab)

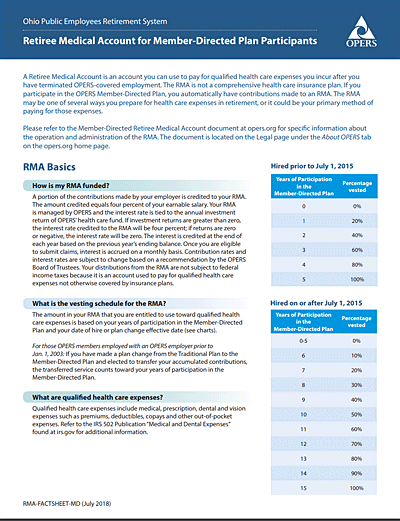

Retiree Medical Account

Under the Member-Directed Plan, a portion of the employer contribution is credited to a Retiree Medical Account. The funds in your RMA may be used to pay for the qualified health, dental and vision care expenses when you retire or leave your OPERS-covered job.

Read: Retiree Medical Account Fact Sheet (PDF opens in new tab)Disability Benefits

OPERS members in the Traditional Pension and Combined Plans are eligible for one of two disability programs, the Original Plan or the Revised Plan and enrollment is either plan is based on when you became an OPERS member.

OPERS also offers a Rehabilitative Services program to help you get back on your feet and back to work.

Read: Disability Benefits (PDF opens in new tab)Law Enforcement Officers

OPERS provides special retirement coverage for certain law enforcement and public safety officers who are required to contribute under the Traditional Pension Plan.

You must meet certain qualifications to be a law enforcement or public safety member covered by OPERS.

Read: Law Enforcement Officers (PDF opens in new tab)Elected Officials

There are specific OPERS membership requirements for elected officials or individuals appointed to publicly elected positions.

Read: Elected Officials (PDF opens in new tab)The OPERS Member Guide to Domestic Relations Issues

The termination of a marriage by divorce, dissolution or annulment may impact your account, regardless of plan. If you and your spouse are getting a legal separation, this proceeding may also impact your account.

It is important to have an understanding of Ohio domestic relations law in relations to your OPERS account.

Read: The OPERS Member Guide to Domestic Relations Issues (PDF opens in new tab)