2026 OPERS Health Care Program Open Enrollment

Open enrollment for 2026 is under way and this means different things depending on whether you are a Pre-Medicare or a Medicare-eligible OPERS benefit recipient.

Open Enrollment To-Do List

- Review the 2026 Open Enrollment email from OPERS each Tuesday.

- Review the Via Benefits Fall newsletter (PDF opens in new tab).

- Review the Open Enrollment materials from OPERS, Via Benefits and your plan carriers.

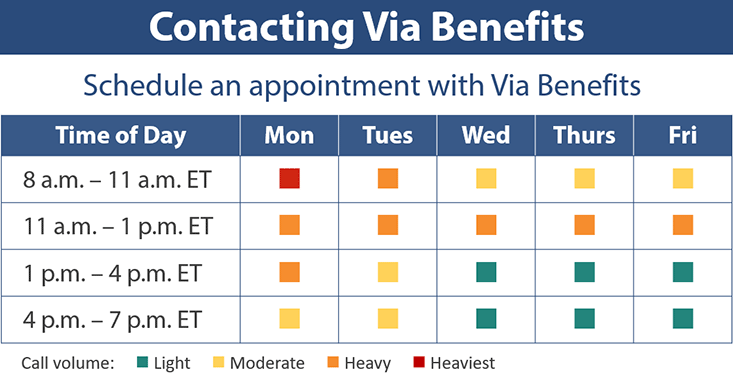

- Schedule an appointment with Via Benefits (if you have questions about your coverage).

- Consider if your medical coverage still works for you.

- Consider if your vision and dental coverage still works for you.

- If you are Pre-Medicare, consider whether your funding decision still works for you (Premium Tax Credit or Health Reimbursement Arrangement) (PDF opens in new tab)

- If you are Medicare-eligible, consider whether your current pharmacy coverage still works for you.

- Know the Open Enrollment deadlines and be certain to add, change or cancel coverage before the deadline.

OPERS Open Enrollment Education

For more information about 2026 open enrollment, we have created a video (PDF opens in new tab) tailored to those benefit recipients receiving (or eligible to receive) a monthly HRA allowance and a video (PDF opens in new tab) tailored to those benefit recipients enrolled in or eligible for the OPERS Vision and Dental plans.

Topics covered:

- OPERS Vision and Dental Plans

- Information about the OPERS HRA

- Authenticating yourself as an OPERS benefit recipient

- Tips for a Smoother Call with Via Benefits

- Scheduling an appointment with Via Benefits

- Understanding the Via Benefits Team

- Understanding Medicare plan types and when to make changes

- Understanding Medicare plan pricing

- Understanding the Via benefits plan roster

- Understanding Marketplace vs. Private Plans

- Know when to make plan changes

Eligibility

Important Open Enrollment dates:

- Pre-Medicare Benefit recipients: Contact; Via Benefits (PDF opens in new tab); between Nov. 1 and Dec. 15, 2025 to discuss your 2026 medical plan.

- Medicare-eligible benefit recipients: Contact; Via Benefits (PDF opens in new tab); between Oct. 15 and Dec. 7, 2025 to discuss your 2026 medical plan.

- OPERS Vision and Dental plans: Enrolling, making changes or canceling vision or dental coverage?; You must complete and return the form within your open enrollment packet or call us no later than Dec. 15, 2025. Termination or change requests received after Dec. 15 will not be accepted. If you have specific questions about how much the plans pay for certain services, please visit; metlife.com/opers (PDF opens in new tab); or call 1-888-262-4874.

If you are eligible for the OPERS Health Reimbursement Arrangement (HRA) in 2026, you will receive the following:

- Personalized statement which features your 2026 monthly HRA deposit amount and premiums for the OPERS vision and dental plans

- 2026 Open Enrollment Insert (pdf opens in new tab) – which provides information about open enrollment, the OPERS health care program, the OPERS HRA, Medicare Requirements and the OPERS vision and dental plans.

- Vision/Dental Open Enrollment Change Form (pdf opens in new tab) to submit if you wish to enroll, make changes to or cancel your OPERS vision and/or dental coverage

If you are NOT eligible for the OPERS HRA but are enrolled in the OPERS vision and/or dental plan, you will receive the following:

- Statement which includes 2026 premiums for the OPERS vision and dental plans

- 2026 Open Enrollment Vision and Dental Plan Insert (pdf opens in new tab) – which provides information about the OPERS vision and dental plans

- Vision/Dental Open Enrollment Change Form (pdf opens in new tab) to submit if you wish to enroll, make changes to or cancel your OPERS vision and/or dental coverage

Pre-Medicare-Eligible OPERS Benefit Recipients

Your HRA Funding Selection

- Are you still in the right funding situation? You can change your funding decision each Open Enrollment Period and your new election will take effect January 1 of the following year. Sign into your Via Benefits online profile and select Your Funding Decision to make changes between Nov. 1 and Dec. 15, 2025. Remember, opting in to the HRA is not the same as having medical insurance. If you are eligible for the OPERS HRA and you choose not to opt in, you are essentially turning down funds that you could use to be reimbursed for qualified medical expenses. This is not something that is deducted from your monthly pension benefit.

Your Medical and Prescription Drug Plan

- Review the 2026 medical and prescription drug plan details provided by your plan administrator and/or insurance carrier. Depending on the administrator and/or carrier, you may receive this information in the mail. If not, visit the administrator's and/or carrier's website. Look for changes in premiums, plan design and prescription drug formulary. If you are enrolled in a medical plan with Via Benefits and are unsure of any changes for 2026 or have questions, reach out to Via Benefits. Or, if you are enrolled in a plan outside of Via Benefits, contact your plan administrator and/or insurance carrier directly..

- Enrolled in a plan through Via Benefits and have questions about your coverage in 2026? Contact Via Benefits (pdf opens in new tab) between Nov. 1 and Dec. 15, 2025. You can call Via Benefits at 1-833-939-1215 and schedule a phone appointment with a Benefits Advisor to review your medical plan details for 2026 during this period. An appointment is not required, but highly recommended.

Medicare-Eligible OPERS Benefit Recipients

- Review the 2026 medical and prescription drug plan details provided by your insurance carrier. Open Enrollment is the best time to update your Medicare Advantage, Prescription Drug, and OPERS vision and dental plans. If you have a Medicare Supplement (Medigap) or non-OPERS dental/vision plan, you can make changes any time of year. To avoid delays, we recommend updating Medigap plans outside the Open Enrollment period, unless you're unhappy with your current coverage.

- Enrolling, making changes or canceling coverage? Contact Via Benefits (link opens in new tab) between Oct. 15 and Dec. 7, 2025. You can call Via Benefits at 1-844-287-9945 and schedule a phone appointment with a Benefits Advisor to discuss your 2026 medical plan. An appointment is not required, but highly recommended. Selecting a Medigap plan may require medical underwriting.

Remember, you must enroll or remain enrolled in a Medicare medical plan through Via Benefits to continue receiving HRA deposits.

OPERS Vision and Dental Plans

Open enrollment is your opportunity to enroll in, cancel or change OPERS vision and/or dental coverage for yourself and any eligible dependents for 2026.

Enrolling, making changes or canceling vision or dental coverage? To terminate your OPERS coverage for 2026, you must complete and return the form within your open enrollment packet or call us no later than Dec. 15, 2025. Termination or change requests received after Dec. 15 will not be accepted.

- If you are enrolled in a vision and/or dental plan with both OPERS and Via Benefits (or another third-party provider), take some time to review your coverage needs to determine if both plans are needed. Enrollment in the OPERS plan(s) is for the entire calendar year and cannot be changed until next year's open enrollment.

- If you have specific questions about how much the plans pay for certain services, please visit metlife.com/opers (pdf opens in new tab) or call 1-888-262-4874.

- No changes to your OPERS vision and dental coverage? No problem. Your enrollment will automatically continue in 2026.

Automatic Reimbursement from your HRA for OPERS Vision and/or Dental Premium(s)

For your convenience, OPERS sends a notice of your paid premiums for all those enrolled in the dental and/or vision plan(s) to Via Benefits for automatic reimbursement from your HRA if funds are available. To view and/or update your automatic reimbursement preference, log into your Via Benefits online account at marketplace.viabenefits.com/opers (pdf opens in new tab) and select View Accounts under the Funds & Reimbursement section or contact Via Benefits at 1-844-287-9945.

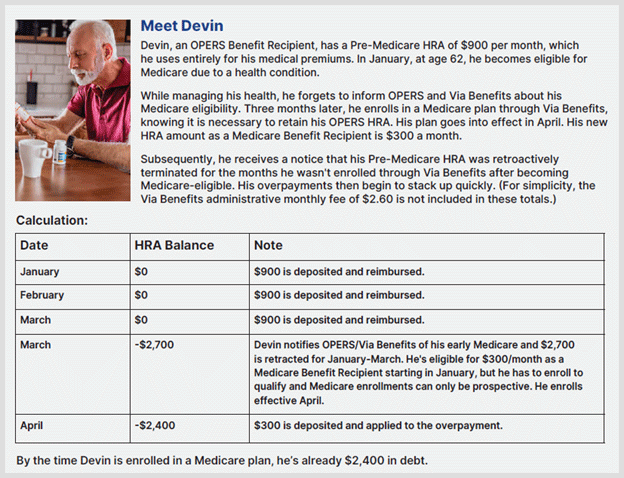

Reminder: Inform OPERS and Via Benefits if you become eligible for Medicare prior to age 65

Your monthly Health Reimbursement Arrangement (HRA) allowance changes once you become eligible for Medicare. If you are under age 65, you must notify OPERS and Via Benefits within 30 days of receiving your Medicare eligibility notification from the Social Security Administration (SSA). This ensures that updates to your HRA can be made prospectively. Failure to do so may result in HRA overpayments, which you would be responsible for repaying.

If you become eligible for Medicare before age 65:

- Contact OPERS to inform them of your Medicare eligibility within 30 days of receiving notification from the SSA.

- Contact Via Benefits to ensure you enroll in a plan to maintain your HRA as a Medicare Benefit Recipient.