New funds effective March 14, 2022

Effective March 14, 2022, OPERS will offer a modified Target Date Fund (TDF) program managed by BlackRock, paired with new Core funds that provide the same investment options we've offered for years. These are funds that have been managed for OPERS by a team at BlackRock for the last decade, and that is not changing. Participants in the Member-Directed or Combined plans will continue to have the same flexibility to make investment decisions suitable for their

individual needs.

Why is OPERS making this change?

As a fiduciary and your trusted retirement partner, OPERS regularly looks at the benefits and products we offer to our members. This includes the investment options available to our Member-Directed and Combined Plan participants.

Do I have to take any action?

No. This change will happen automatically behind the scenes with your current balance transferring into the corresponding fund.

Will my account balance change?

No. Your account balance will not change due to this transition, but we expect to see account balances change due to the normal market fluctuations experienced by all investors every day they remain invested.

Are there other resources available to learn more?

Below you will find additional resources to familiarize yourself with the investment options available on March 14, as well as a video on TDFs at BlackRock, and other FAQs you may have. Should you have any other questions, please call us at 1-800-222-7377 (PERS).

Resources

Fund Profiles

Below are profiles of all the funds we will be transitioning into in March 2022.

Target Date Funds

- BlackRock® LifePath® Index Retirement Fund

- BlackRock® LifePath® 2030 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2035 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2040 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2045 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2050 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2055 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2060 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2065 Fund (PDF opens in new tab)

- BlackRock® LifePath® 2070 Fund (PDF opens in new tab)

Target Date Fund Video

A video provided by BlackRock that explains what TDFs can do for investors.

FAQ

- What is happening?

-

Effective March 14, 2022, OPERS will offer a modified Target Date Fund (TDF) program managed by BlackRock, paired with new Core funds that provide the same investment options we've offered for years. These are funds that have been managed for OPERS by a team at BlackRock for the last decade, and that is not changing.

Additionally, we're increasing the amount of money members may allocate to the Schwab Self-Directed Brokerage Account to 90% of a member's balance once that balance reaches the $5,000 minimum account level.

- Why is OPERS making this change?

-

As a fiduciary and your trusted retirement partner, OPERS regularly looks at the benefits and products we offer to our members. This includes the investment options available to our Member-Directed and Combined Plan participants.

- Do I have to take any action?

-

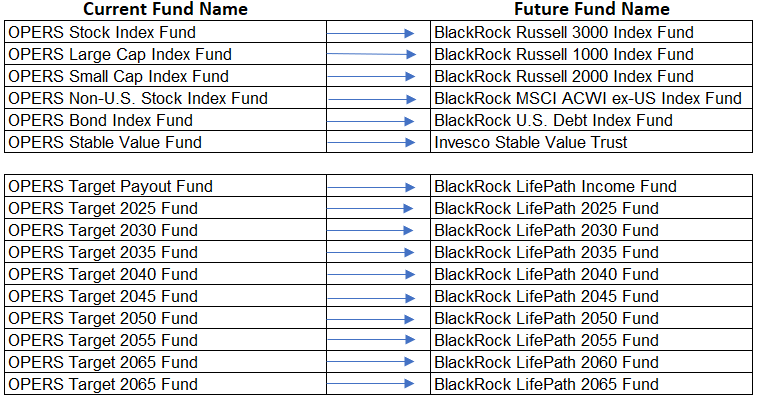

No. This change will happen automatically behind the scenes with your current balance transferring into the corresponding fund as illustrated below.

- Will my account balance change?

-

No. Your account balance will not change due to this transition, but we expect to see account balances change due to the normal market fluctuations experienced by all investors every day they remain invested.

- Will trading be restricted in my account at any time?

-

No. Any trade entered on Friday, March 11, 2022 will be processed that evening, as usual. Over the weekend of March 12-13, Voya will transition your investments automatically from the current funds to the new funds mapped as displayed above.

- May I opt-out of this change?

-

No. This enhancement will result in the change of all the investment options available on the OPERS defined contribution platform. All old investments will be sold at the valuation at the end of the day on March 11, 2022 with the new assets purchased at that time.

- When will I be able to see the new funds in my account?

-

The transition will be processed over the weekend at Voya enabling you to see the new funds in your account on the next business day, Monday, March 14, 2022.

- What can I expect next?

-

We will send more information to those directly impacted. Please make sure your contact information is up to date in your online account.